Dive into the dynamic world of Business environment risk management where risks and strategies collide to shape the future of businesses. Get ready for an enlightening journey filled with insights and examples that will change your perspective on risk management forever!

In this overview, we’ll explore the intricate relationship between business environments and risk management, uncovering key components, strategies, and types of risks that businesses face daily.

Business Environment

In the context of risk management, the business environment refers to all external factors that can impact a company’s operations, performance, and success. It includes a wide range of elements that a business cannot control but must adapt to in order to thrive and mitigate risks effectively.

Key Components of a Business Environment

- Economic factors: such as inflation, interest rates, and economic growth.

- Political factors: including government stability, policies, and regulations.

- Social factors: such as demographics, cultural trends, and consumer behavior.

- Technological factors: advancements, innovations, and disruptions in technology.

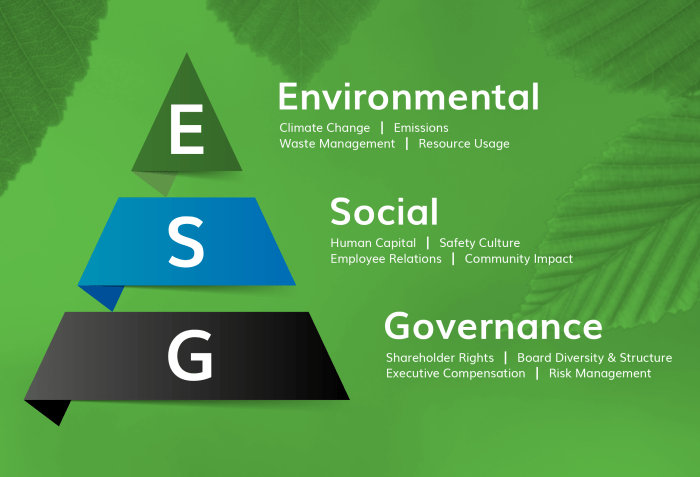

- Environmental factors: sustainability, climate change, and natural disasters.

- Legal factors: laws, regulations, and compliance requirements.

Impact on Risk Management Strategies

- The business environment directly influences the types of risks a company may face, such as market risks, regulatory risks, or technological risks.

- Changes in the business environment can lead to the need for adjustments in risk management strategies to remain competitive and resilient.

- By understanding and analyzing the business environment, companies can anticipate potential risks and develop proactive risk management plans.

External Factors Influencing the Business Environment

- Global economic conditions, such as trade policies and exchange rates, can impact a company’s financial stability and market opportunities.

- Policies and regulations set by governments can affect business operations, supply chains, and overall compliance requirements.

- Consumer preferences and behaviors, influenced by social trends and cultural shifts, can impact product demand and market positioning.

- Technological advancements and disruptions can create new opportunities but also introduce cybersecurity threats and operational challenges.

Risk Management Strategies

Risk management is a crucial aspect of business operations, as it helps organizations identify, assess, and mitigate potential risks that could impact their success. There are several risk management strategies used in business environments, each with its own approach and benefits. In this section, we will explore different risk management strategies, compare proactive and reactive approaches, highlight the importance of risk assessment, and provide real-world examples of successful risk management strategies in challenging business environments.

Proactive vs. Reactive Risk Management

Proactive risk management involves identifying and addressing potential risks before they occur, focusing on prevention and mitigation strategies. On the other hand, reactive risk management responds to risks after they have already impacted the business, often resulting in higher costs and greater damage. While proactive risk management allows organizations to anticipate and prepare for potential threats, reactive risk management is more about damage control and recovery.

Importance of Risk Assessment

Risk assessment is a critical step in developing effective risk management strategies, as it helps organizations understand the nature and impact of various risks they may face. By conducting a thorough risk assessment, businesses can prioritize risks, allocate resources efficiently, and implement targeted risk mitigation measures. This proactive approach enables organizations to minimize the likelihood and impact of potential threats, enhancing their overall resilience and sustainability.

Successful Risk Management Strategies in Challenging Business Environments

One example of a successful risk management strategy in a challenging business environment is diversification. By spreading investments across different industries or markets, organizations can reduce their exposure to specific risks and enhance their overall stability. Another effective strategy is contingency planning, where businesses develop response plans for various scenarios to ensure continuity in the face of unexpected events.

Types of Business Risks

In the ever-evolving business landscape, organizations face various risks that can impact their operations and financial stability. It is crucial for businesses to identify and manage these risks effectively to ensure long-term sustainability and success.

Financial Risks

Financial risks are a common concern for businesses and can arise from factors such as market fluctuations, economic downturns, or poor financial planning. These risks can have a significant impact on a company’s bottom line, leading to reduced profits, cash flow issues, or even bankruptcy. By implementing robust financial risk management strategies, businesses can mitigate these risks and safeguard their financial health.

This may include diversifying investments, maintaining adequate cash reserves, and monitoring financial performance closely.

Operational Risks

Operational risks refer to the potential threats that can disrupt business operations and impact productivity. These risks can stem from internal factors such as human error, technology failures, or supply chain disruptions. To mitigate operational risks, organizations can implement measures such as establishing contingency plans, conducting regular risk assessments, and investing in appropriate technology and infrastructure. By proactively addressing operational risks, businesses can enhance their resilience and ensure continuity of operations.

Strategic Risks

Strategic risks are related to the long-term goals and direction of a business and can arise from factors such as changes in market trends, competitive pressures, or regulatory changes. Identifying and managing strategic risks is crucial for ensuring the sustainable growth and success of a company. By conducting strategic risk assessments, businesses can anticipate potential challenges, seize opportunities for growth, and adapt their strategies accordingly.

Effective strategic risk management enables organizations to stay ahead of the curve and remain competitive in a rapidly changing business environment.

Risk Assessment and Mitigation

Risk assessment plays a crucial role in effective risk management for businesses. By identifying potential risks and evaluating their impact, businesses can develop strategies to mitigate or eliminate these risks before they cause harm. Let’s delve into the process of risk assessment and its importance in a dynamic business environment.

Step-by-Step Guide to Conduct Risk Assessments

- Identify potential risks: Start by identifying all possible risks that could affect your business operations, such as financial risks, operational risks, or market risks.

- Assess the likelihood and impact: Evaluate the likelihood of each risk occurring and its potential impact on your business in terms of costs, reputation, or compliance.

- Prioritize risks: Rank the identified risks based on their likelihood and impact to focus on addressing the most critical ones first.

- Develop risk mitigation strategies: Once you have identified and prioritized risks, develop tailored strategies to mitigate or manage each risk effectively.

- Implement risk mitigation plans: Put the risk mitigation plans into action by assigning responsibilities, setting timelines, and monitoring progress regularly.

Continuous Monitoring and Mitigation of Risks

Continuous monitoring of risks is essential in a dynamic business environment to ensure that new risks are identified and existing risks are managed effectively. By staying vigilant and adapting to changing circumstances, businesses can proactively address emerging threats and opportunities.

Best Practices for Developing Risk Mitigation Plans

“Preparation is key in risk management.”

- Engage stakeholders: Involve key stakeholders in the risk assessment process to gain diverse perspectives and insights.

- Stay informed: Keep abreast of industry trends, regulatory changes, and market shifts to anticipate potential risks and opportunities.

- Regularly review and update: Periodically review and update your risk mitigation plans to align with evolving business goals and external factors.

- Test your plans: Conduct regular simulations or scenario planning exercises to test the effectiveness of your risk mitigation strategies.

- Communicate effectively: Ensure clear communication of risk management strategies and responsibilities to all employees to promote a culture of risk awareness and accountability.

Closing Notes

As we wrap up our exploration of Business environment risk management, remember that proactive risk assessment and effective mitigation plans are the keys to thriving in today’s ever-changing business landscape. Stay informed, stay vigilant, and stay ahead of the game!

FAQ

How does the business environment influence risk management strategies?

The business environment, including economic trends and regulatory changes, can significantly impact the development and implementation of risk management strategies.

What are some examples of external factors affecting the business environment?

External factors like political instability, technological advancements, and natural disasters can all influence the business environment and pose risks that need to be managed.

What is the importance of continuous monitoring in risk management?

Continuous monitoring helps businesses stay proactive in identifying and addressing emerging risks, ensuring that mitigation strategies remain effective in changing environments.